Choose the Plan that is right for you

₹5000 off on StockEdge PRO Annual Plan | Promo Code - SPINWIN

In case of any queries or questions,

Exclusive Pro-Only Features

15+ Chart Patterns Categorized into Bullish, Neutral and Bearish

See recently formed patterns. You can also see algorithm’s past performance and trend after detection in past section.

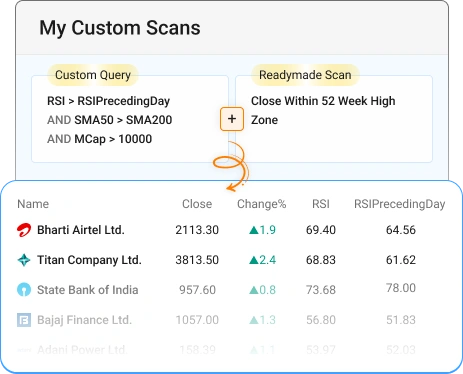

Get Customization with Convenience

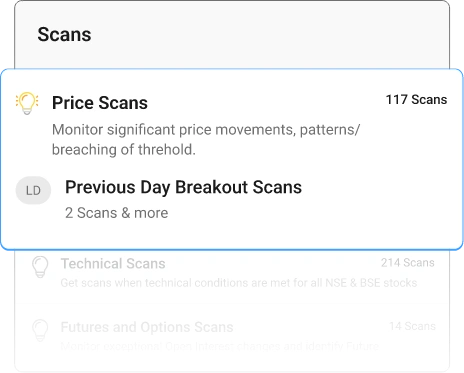

Write your own Custom Query and combine with the ready 500+ scans to discover stocks.

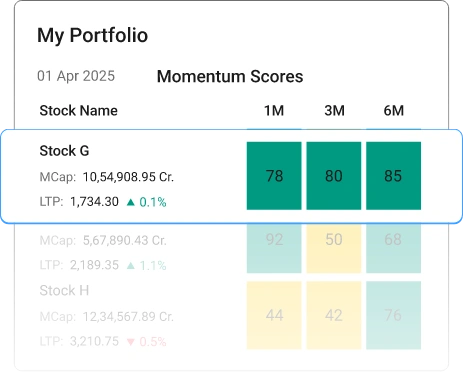

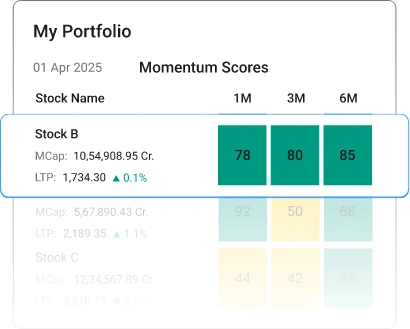

Track Momentum for your Portfolio Stocks

Track Momentum for your Portfolio and Watchlist Stocks, also get this view to analyze trends across Sectors, Industries, and Indices.

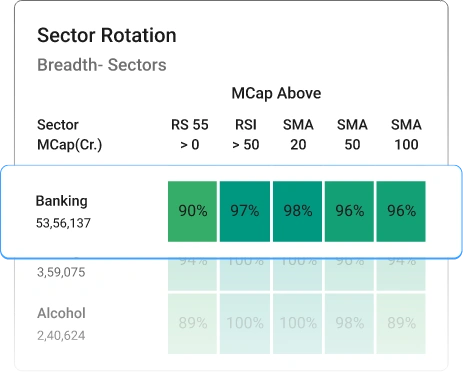

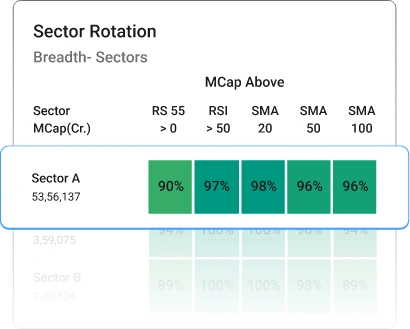

Catch Sector Trends Early

Dig deeper to analyze top industries & stocks in different sectors. Identify the strength and momentum of stocks with top-down investment technique.

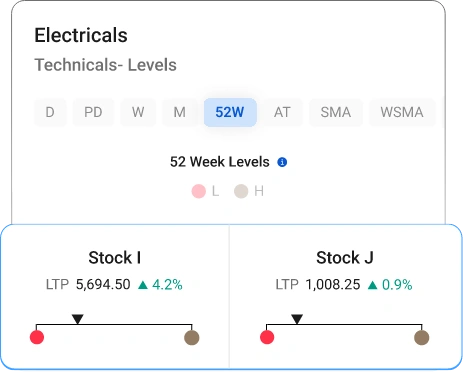

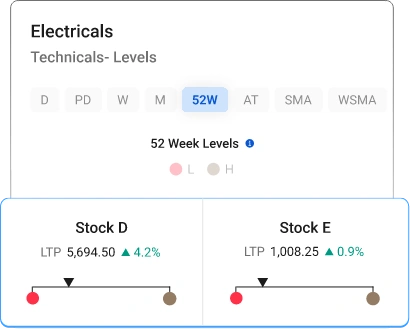

Compare Stocks with Peers 20+ Parameters

Get Visual View Compare Sector, Industry, Indices Peers, your personal watchlist and portfolio stocks on Price Behavior, Technical Indicators and more.

AI Generated

AI Generated Know Stocks

Know Stocks Catch Sectoral

Catch Sectoral Compare

Compare